Finding the best car insurance in Illinois can be a major hurdle for young drivers, especially when you consider the statistics: those under 25 are nearly three times more likely to be involved in a fatal crash than older drivers. This elevated risk profile translates to higher insurance premiums for young people in the state.

Toc

Understanding the Unique Challenges of Car Insurance for Young Drivers in Illinois

Inexperience and Reckless Driving Behaviors

Inexperience behind the wheel, coupled with a tendency for risky driving habits such as speeding and distracted driving, makes young drivers more prone to accidents. Insurance companies view this age group as higher-risk, leading to inflated premiums. The lack of established driving history means insurers have less data to assess risk, resulting in higher rates.

Lack of Driving History

With limited time on the road, young drivers in Illinois lack the extensive driving history that can help lower insurance rates. This lack of driving history can be particularly challenging for young drivers who are new to the road. Insurance companies rely on historical data to assess risk and determine premiums. Without a significant driving history, insurers have limited information to evaluate a young driver’s potential for accidents. This uncertainty often leads to higher premiums, as insurers need to account for the increased risk associated with limited experience. As they gain more experience, the likelihood of being involved in a crash decreases, leading to potential savings on their car insurance. Insurers often reward long-term customers with lower rates, making it crucial for young drivers to build a clean record over time.

Vehicle Type and Coverage Levels

The type of vehicle driven and the level of coverage selected can significantly impact insurance costs for young drivers in Illinois. High-performance cars and comprehensive coverage plans tend to be more expensive. For instance, a high-performance sports car like a Chevrolet Camaro or a Ford Mustang often carries higher insurance premiums due to their higher repair costs and increased risk of accidents associated with their speed and power. Insurance companies often charge higher rates for vehicles that are costly to repair or replace, which can be a critical consideration for young drivers who may be tempted to choose flashy or powerful cars.

Location and Demographics

Another significant factor affecting car insurance rates in Illinois is location. Urban areas with higher traffic density, such as Chicago, often have higher rates due to increased accident frequency and crime rates. Conversely, rural areas may offer lower premiums. Additionally, demographic factors such as credit score and marital status can influence rates, as insurers often consider these variables when assessing risk.

Top Tips for Young Drivers

Navigating these challenges, there are several strategies young drivers in Illinois can employ to secure more affordable car insurance coverage:

Shop Around and Compare Quotes

Comparing quotes from multiple insurers is crucial. Each company evaluates risk factors differently, so young drivers can find vastly different rates by shopping around. Utilize online comparison tools and work with local insurance agents to explore all available options. This process can save you hundreds of dollars annually, especially if you take the time to research and negotiate. While comparing quotes is essential, it’s also crucial to consider your individual needs and preferences. Some insurers may offer lower rates but might have limited customer service options or a narrow coverage range. It’s important to find an insurer that aligns with your specific requirements, whether it’s affordability, ease of use, or the breadth of coverage options.

Maximize Discounts and Savings

Look for discounts that can help lower your car insurance premiums. Many providers offer various discounts that cater specifically to young drivers, including:

- Good Student Discounts: Many insurers offer lower rates for students who maintain a certain GPA, typically a B average or higher.

- Driver Education Discounts: Completing an approved driver education course can qualify you for a discount. For example, the Illinois Secretary of State offers the ‘Illinois Safe Driver Course’ which can qualify you for a discount.

- Multi-Car Discounts: If your family has multiple vehicles, insuring them under the same policy can lead to significant savings.

- Bundling Discounts: Consider bundling your car insurance with other insurance products, such as homeowners or renters insurance, to secure a lower rate.

Consider Minimum Coverage

While it’s essential to have adequate protection, opting for the minimum required coverage in Illinois can be a cost-effective solution for young drivers on a tight budget. Illinois requires a minimum level of liability coverage, which includes:

- Bodily injury liability: $25,000 per person, $50,000 per accident

- Property damage liability: $20,000 per accident

- Uninsured/underinsured motorist coverage: $25,000 per person, $50,000 per accident

For young drivers with limited financial resources, the minimum coverage may be a practical choice. However, it’s crucial to weigh the potential risks and consider upgrading to a higher level of protection if your financial situation allows.

Maintain a Clean Driving Record

Avoiding traffic violations, speeding tickets, and at-fault accidents is crucial for keeping your insurance costs down. Insurers view drivers with clean records as lower-risk, potentially leading to substantial savings on your car insurance. Developing safe driving habits is vital for young drivers to establish a positive driving history, which can lead to lower premiums over time. While maintaining a clean driving record is crucial, it’s important to remember that accidents can happen even with the safest driving habits. If you are involved in an accident, it’s essential to be upfront with your insurer and provide accurate information. This transparency can help mitigate the potential impact on your premiums.

1. https://dailymercedes-benz.vn/mmoga-best-car-insurance-in-florida-find-affordable-coverage-today

5. https://dailymercedes-benz.vn/mmoga-finding-the-best-home-insurance-for-first-time-homebuyers

Enroll in Driver Education Courses

Many insurers offer discounts for young drivers who complete approved driver education or defensive driving courses. These programs can not only improve your skills but also lead to significant savings on your car insurance. By showcasing your commitment to safer driving, you can potentially earn discounts that help offset the higher premiums young drivers typically face.

Choose a Less Expensive Vehicle

The type of vehicle you drive can also impact your insurance costs. Opting for a safer, less powerful, and less expensive car can help lower your premiums. Choosing a less expensive vehicle can be a cost-effective strategy for young drivers, but it’s important to consider your individual needs and preferences. If you require a vehicle for work, transportation of family members, or other specific purposes, choosing a less expensive car might not be feasible or practical. It’s crucial to find a balance between affordability and functionality when selecting a vehicle. Insurance companies often charge higher rates for high-performance or luxury vehicles, as they are more costly to repair or replace in the event of an accident. Choosing a more practical, budget-friendly car can result in substantial savings.

Review Your Policy Regularly

It’s essential to review your insurance policy annually to ensure you have the right coverage and to identify potential savings opportunities. As your circumstances change, such as moving to a different area, changing jobs, or graduating from school, your insurance needs may also evolve. Regularly comparing quotes can help you stay on top of the most affordable car insurance solutions.

Current Trends in Car Insurance

A recent trend in the car insurance industry is the rise of usage-based insurance (UBI) programs. These programs use telematics devices, often in the form of smartphone apps, to track your driving habits. Data such as speed, braking, and time of day driving is collected and used to determine your premium. Young drivers who demonstrate safe driving behaviors can often benefit from lower rates through UBI programs, as they can prove their responsible driving habits.

Popular Car Insurance Companies in Illinois

When searching for the best car insurance in Illinois, several companies stand out for their competitive rates and customer-centric approach:

Pekin Insurance

Pekin Insurance is known for its affordable car insurance options, making it a popular choice for young drivers in Illinois. According to our research, Pekin Insurance offers the cheapest minimum liability coverage in the state, with an average monthly cost of around $56. Their customer service is also highly rated, making it a reliable option for first-time insurance buyers.

COUNTRY Financial

COUNTRY Financial is another insurance provider that offers competitive rates for young drivers in Illinois. Our analysis shows that COUNTRY Financial has the second-lowest average monthly rates for this age group, making it a strong contender for affordable car insurance. They are also recognized for their excellent customer service and comprehensive coverage options, which can be beneficial for young drivers seeking support.

State Farm

As a nationwide insurance leader, State Farm has a strong presence in Illinois and is often a go-to choice for young drivers. While not the absolute cheapest, State Farm’s rates for young drivers in Illinois are still competitive, with an average monthly cost of around $79. Their extensive network of agents and a wide range of coverage options make them a reliable option for affordable car insurance.

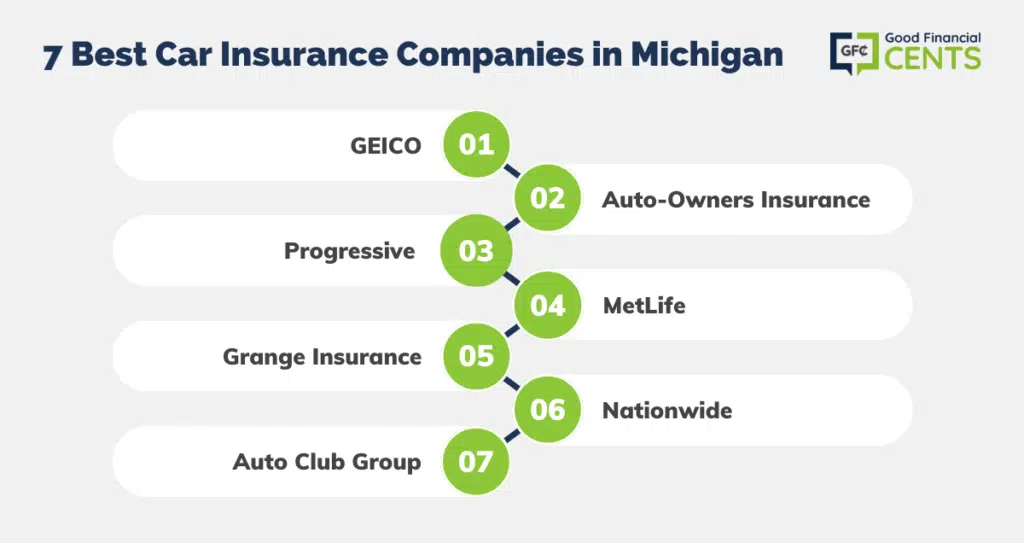

GEICO

GEICO is known for its competitive rates and innovative digital-first approach. They offer a user-friendly online platform that allows young drivers to easily compare quotes, manage their policies, and file claims. GEICO also provides various discounts, making it an attractive option for budget-conscious young drivers in Illinois.

Progressive

Progressive stands out for its personalized pricing and innovative features, such as the Name Your Price tool. This unique approach allows young drivers to input their budget and receive coverage options that fit within their financial constraints. Additionally, Progressive offers numerous discounts, making it a strong candidate for affordable car insurance.

Allstate

Allstate is recognized for its comprehensive coverage options and customer service. Their “Drive Safe & Save” program rewards safe driving behavior with potential discounts on premiums. Allstate’s wide range of insurance products and strong local agent presence make them a popular choice among young drivers looking for reliable coverage in Illinois.

Farmers Insurance

Farmers Insurance focuses on personalized service, providing local agents who understand the unique needs of their clients. They offer a range of insurance products, including auto insurance tailored for young drivers. Farmers’ commitment to customer satisfaction and flexible coverage options make them a noteworthy contender in the Illinois market.

In addition to traditional insurance companies, there are also a growing number of online insurance providers catering to young drivers. These companies often offer competitive rates and streamlined online processes, making it easier for young drivers to manage their insurance needs digitally. Some notable examples of online insurance providers include Lemonade, Root, and Metromile.

3. https://dailymercedes-benz.vn/mmoga-best-car-insurance-in-florida-find-affordable-coverage-today

4. https://dailymercedes-benz.vn/mmoga-finding-the-best-home-insurance-for-first-time-homebuyers

Frequently Asked Questions

Q: What is the minimum car insurance coverage required in Illinois?

A: The minimum car insurance coverage required in Illinois includes:

- Bodily injury liability: $25,000 per person, $50,000 per accident

- Property damage liability: $20,000 per accident

- Uninsured/underinsured motorist coverage: $25,000 per person, $50,000 per accident

Q: How can I get a good student discount on my car insurance in Illinois?

A: Many insurance companies offer good student discounts to young drivers who maintain a B average or higher in school. To qualify, you’ll typically need to provide proof of your academic performance, such as a report card or transcript.

Q: Is it worth it to get full coverage car insurance as a young driver in Illinois?

A: While full coverage car insurance can be more expensive for young drivers, it may be worth considering if you have a car loan or lease. Full coverage provides additional protection for your vehicle, which can be valuable in the event of an accident or incident. Weigh the potential costs and benefits to determine the right coverage level for your needs and budget.

Q: How can I lower my car insurance premiums if I have a poor driving record?

A: For drivers with a bad driving record, consider taking defensive driving courses, which can sometimes lead to discounts. Additionally, look for specialized insurers that cater to high-risk drivers. Regularly shopping around for quotes and being proactive about improving your driving habits can also help lower premiums over time.

Conclusion

Finding the best car insurance in Illinois as a young driver requires a strategic approach, but it’s not an impossible task. By understanding the factors that influence premium costs, exploring affordable options, and taking advantage of available discounts, you can secure the coverage you need without breaking the bank.

Start comparing quotes from reputable insurance providers like Pekin, COUNTRY Financial, State Farm, GEICO, Progressive, Allstate, and Farmers Insurance to find the most suitable car insurance solution for your unique situation. With a little diligence and smart decision-making, young drivers in Illinois can enjoy the freedom of the road while staying protected and within their budget.