You’ve finally achieved the dream of homeownership, but now you’re faced with another hurdle: choosing the right home insurance. While many assume it’s a straightforward process, finding the best home insurance requires careful consideration of your specific needs and a thorough understanding of the available coverage options. This guide will walk you through the essential coverages, how to compare the best home insurance companies, and tips for maximizing your savings.

Toc

- 1. Understanding Your Coverage Needs

- 2. Understanding the Basics of the Best Home Insurance

- 3. Shopping for the Right Policy

- 4. Related articles 01:

- 5. Additional Coverage Options for First-Time Homebuyers

- 6. Protecting Your Home Beyond Coverage

- 7. Related articles 02:

- 8. Key Considerations for First-Time Homebuyers

- 9. Conclusion

Understanding Your Coverage Needs

Before diving into the specifics of the best homeowners insurance, it’s crucial to understand what coverage you need based on your circumstances. Assessing your risk factors, such as location, the age of your home, and the value of your possessions, will help you determine the appropriate coverage levels and options available to you.

Understanding the Basics of the Best Home Insurance

Home insurance is designed to protect your most significant investment — your home. It covers various aspects, from the physical structure to your personal belongings. Here’s a closer look at the fundamental coverage types included in the best house insurance policies:

Dwelling Coverage

Dwelling coverage is a vital component of the best homeowner insurance. It protects the physical structure of your home, including the roof, walls, and foundation. In case of a covered peril, like a fire or severe weather, this coverage helps pay for the cost of repairing or rebuilding your home. It’s important to assess the replacement cost of your home accurately, as underinsuring can leave you vulnerable in the event of a disaster.

Personal Property Coverage

This type of coverage safeguards your belongings inside the home. Whether it’s furniture, electronics, or clothing, personal property coverage ensures that you receive reimbursement if your possessions are damaged, stolen, or destroyed. For high-value items like jewelry, art, or antiques, you might want to consider “scheduled personal property” coverage. This provides additional protection beyond standard limits and ensures you receive full replacement value in case of loss or damage. It’s crucial to document and appraise these items for accurate coverage.

Liability Coverage

Liability coverage is crucial for any homeowner. It protects you financially if someone is injured on your property or if you’re found legally responsible for damage to someone else’s property. This coverage can help cover medical expenses, legal fees, and other related costs. Many policies offer a standard amount of liability coverage, but it may be wise to increase this limit based on your personal circumstances and assets.

Additional Living Expenses

If your home becomes uninhabitable due to a covered event, additional living expenses (ALE) coverage can help you pay for temporary housing, meals, and other costs you incur while your home is being repaired or rebuilt. For instance, if your home is uninhabitable due to a fire, ALE coverage can help pay for temporary housing, meals, and other essential expenses while repairs are underway. The coverage amount is usually a percentage of your dwelling coverage, and there may be time limits on how long it’s active. It’s important to understand these limitations when choosing your policy, as they can significantly affect your financial situation during a crisis.

Replacement Cost vs- Actual Cash Value

When choosing your coverage limits, it’s essential to understand the difference between replacement cost and actual cash value. Replacement cost pays for the full cost of replacing your home or belongings, while actual cash value considers depreciation. Opting for replacement cost coverage often provides better protection, especially for personal property, as it ensures you can replace items at their current market value without factoring in depreciation. However, while replacement cost coverage offers comprehensive protection, it can result in higher premiums compared to actual cash value. It’s important to weigh the potential benefits against the cost and consider your financial situation when making this decision.

Shopping for the Right Policy

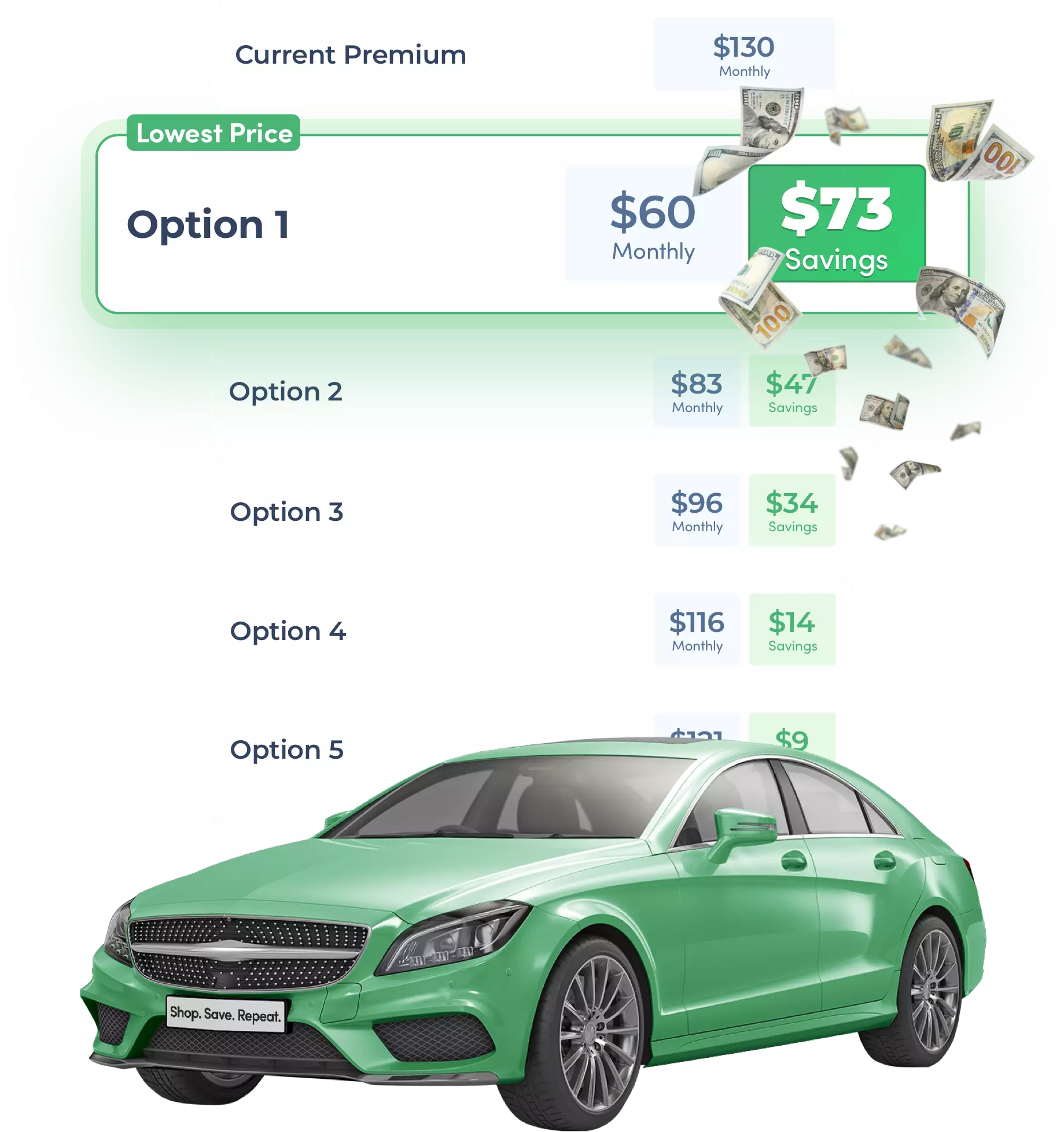

Finding the best home insurance involves shopping around and comparing quotes from multiple insurers. Here are some tips to help you evaluate the best home insurance companies:

Researching Financial Strength and Reputation

Start by investigating the financial stability and reputation of the insurance companies you’re considering. Look for insurers with strong financial ratings from agencies like A.M. Best and read customer reviews to gauge their claims handling history. A reliable insurer is crucial for your peace of mind, as you want to ensure they will be there when you need to file a claim.

Exploring Bundling Options

One of the best ways to save on your insurance is by bundling your home and auto policies with the same provider. Many of the best home insurance companies offer significant discounts for bundled policies, simplifying your insurance management and saving you money. This approach not only lowers your premiums but also provides a single point of contact for your insurance needs, making it easier to manage your policies.

1. https://dailymercedes-benz.vn/archive/1628/

2. https://dailymercedes-benz.vn/archive/1629/

3. https://dailymercedes-benz.vn/archive/1624/

Maximizing Discounts

Home insurance companies often provide various discounts that can help lower your premiums. Take advantage of discounts for safety features such as smoke detectors, security systems, and being a first-time homebuyer. Additionally, paying your premiums in full or maintaining a claims-free history can lead to further savings. While many discounts are available, it’s essential to remember that they may not always apply to all policies or insurers. It’s crucial to compare quotes from different providers and inquire about specific discount eligibility criteria before making a decision.

Considering Deductibles

The deductible you choose can significantly impact your home insurance premium. Generally, a higher deductible means a lower premium, but it’s essential to select a deductible amount that you can comfortably afford in the event of a claim. Assess your financial situation and risk tolerance when deciding on your deductible, as it plays a crucial role in your overall insurance costs.

Additional Coverage Options for First-Time Homebuyers

While standard home insurance policies provide a solid foundation of protection, there may be additional coverage options worth considering as a first-time homebuyer:

Flood Insurance

Most standard home insurance policies do not cover flood damage. If your home is located in a flood-prone area, consider purchasing a separate flood insurance policy through the National Flood Insurance Program (NFIP) or a private insurer. Before deciding on flood insurance, carefully evaluate your home’s location and its history of flooding. This will help you determine your risk and make an informed decision about coverage. This additional protection can be a lifesaver in the event of a natural disaster.

Earthquake Insurance

Depending on your geographic location, earthquake insurance may also be a critical consideration. This coverage is often an optional add-on to your home insurance policy and can provide financial protection in the event of a seismic event. If you live in an area prone to earthquakes, this coverage can be an invaluable addition to your insurance portfolio.

Scheduled Personal Property Coverage

If you own high-value items such as jewelry, art, or collectibles, consider scheduling them on your home insurance policy. This ensures they receive the proper coverage and protection beyond the standard personal property limits. Many insurers offer the option to add a rider to your policy, providing additional coverage tailored to your valuable possessions.

Water Backup Coverage

Water backup coverage is another important consideration, especially for homeowners with basements. This coverage protects against damage caused by backed-up sewers or drains, which is typically not included in standard home insurance policies. If your home is at risk for flooding or water damage, adding this coverage can provide additional peace of mind.

Current Trends in Home Insurance

In recent years, the frequency and severity of climate-related events like wildfires, hurricanes, and floods have increased significantly. This trend has impacted home insurance premiums, with insurers adjusting rates to reflect the higher risk in certain areas. As a first-time homebuyer, it’s essential to consider the potential impact of climate change on your home insurance costs and ensure you have adequate coverage for these risks.

Protecting Your Home Beyond Coverage

Implementing security measures and regular maintenance can help reduce insurance premiums and protect your home. Here are some effective strategies:

Smart Home Technology

Investing in smart home devices, such as connected smoke detectors, security cameras, and smart locks, can qualify you for discounts on your home insurance premiums. Examples of smart home devices that can qualify for discounts include connected smoke detectors, security cameras, smart locks, and motion sensors. These devices can provide real-time alerts, deter crime, and help insurers assess your risk profile. Insurers appreciate proactive homeowners who take steps to enhance their property’s security. Smart home technology not only improves safety but also allows you to monitor your home remotely, adding an extra layer of security.

Burglar Alarms and Monitoring

Installing a professional-grade burglar alarm system, especially one monitored by a security company, can lead to substantial discounts on your best homeowners insurance. These systems deter break-ins and provide an added layer of protection. Many insurers offer discounts for homes equipped with such systems, recognizing the reduced risk associated with monitored alarms.

Fire Safety Upgrades

Enhancing your home’s fire safety can also result in savings. Consider installing additional smoke detectors, upgrading fire extinguishers, or investing in a residential sprinkler system. Insurers recognize these measures as effective ways to mitigate fire-related risks. Regularly checking and maintaining these safety devices can further ensure your home remains protected.

1. https://dailymercedes-benz.vn/archive/1624/

2. https://dailymercedes-benz.vn/archive/1625/

3. https://dailymercedes-benz.vn/archive/1629/

Regular Maintenance

Routine home maintenance, such as roof inspections, plumbing checks, and electrical system evaluations, can help prevent costly damage and reduce insurance premiums. A well-maintained home is less likely to experience severe issues that could lead to insurance claims. Keeping a maintenance log can also be beneficial when discussing coverage with your insurer.

Key Considerations for First-Time Homebuyers

What is the average cost of home insurance for first-time homebuyers?

The cost of home insurance can vary widely based on factors such as location, size, age of the home, and the coverage limits you choose. On average, first-time homebuyers can expect to pay between $1,000 and $2,000 annually for the best homeowners insurance. However, this can fluctuate significantly depending on individual circumstances.

How do I find a reputable insurance agent?

Ask friends, family, or your real estate agent for referrals to local insurance agents with experience working with first-time homebuyers. Look for agents who are knowledgeable about the home insurance market and can provide personalized guidance. Online reviews and ratings can also help you gauge an agent’s reputation.

What are some common mistakes first-time homebuyers make with home insurance?

Common mistakes include underestimating coverage needs, choosing a deductible that’s too high, failing to shop around for the best rates, and not taking advantage of available discounts. It’s crucial to thoroughly understand the exclusions in your home insurance policy. This will prevent surprises and ensure you’re prepared for any potential claim. Many first-time buyers may also overlook the importance of understanding policy exclusions, which can lead to surprises when filing a claim.

How often should I review my home insurance policy?

It’s recommended to review your home insurance policy annually or more frequently if there are significant changes to your home, possessions, or risk factors. This ensures your coverage remains up-to-date and adequate for your evolving needs. Life events such as renovations, acquiring new valuables, or changes in family status can all impact your coverage requirements.

Conclusion

Finding the best home insurance as a first-time homebuyer is crucial for protecting your investment and ensuring peace of mind. By understanding essential coverages, comparing quotes from multiple insurers, and maximizing available discounts, you can secure a policy that meets your needs and fits your budget. Remember to review your policy regularly and consider additional coverage options as your needs evolve. Taking the time to research and compare options now can save you from unexpected financial burdens down the road. With the right home insurance, you can confidently enjoy your new home, knowing you have the protection you need. The journey to homeownership is significant, and having the right insurance in place is a vital step in securing your future.